Ultimate RSI

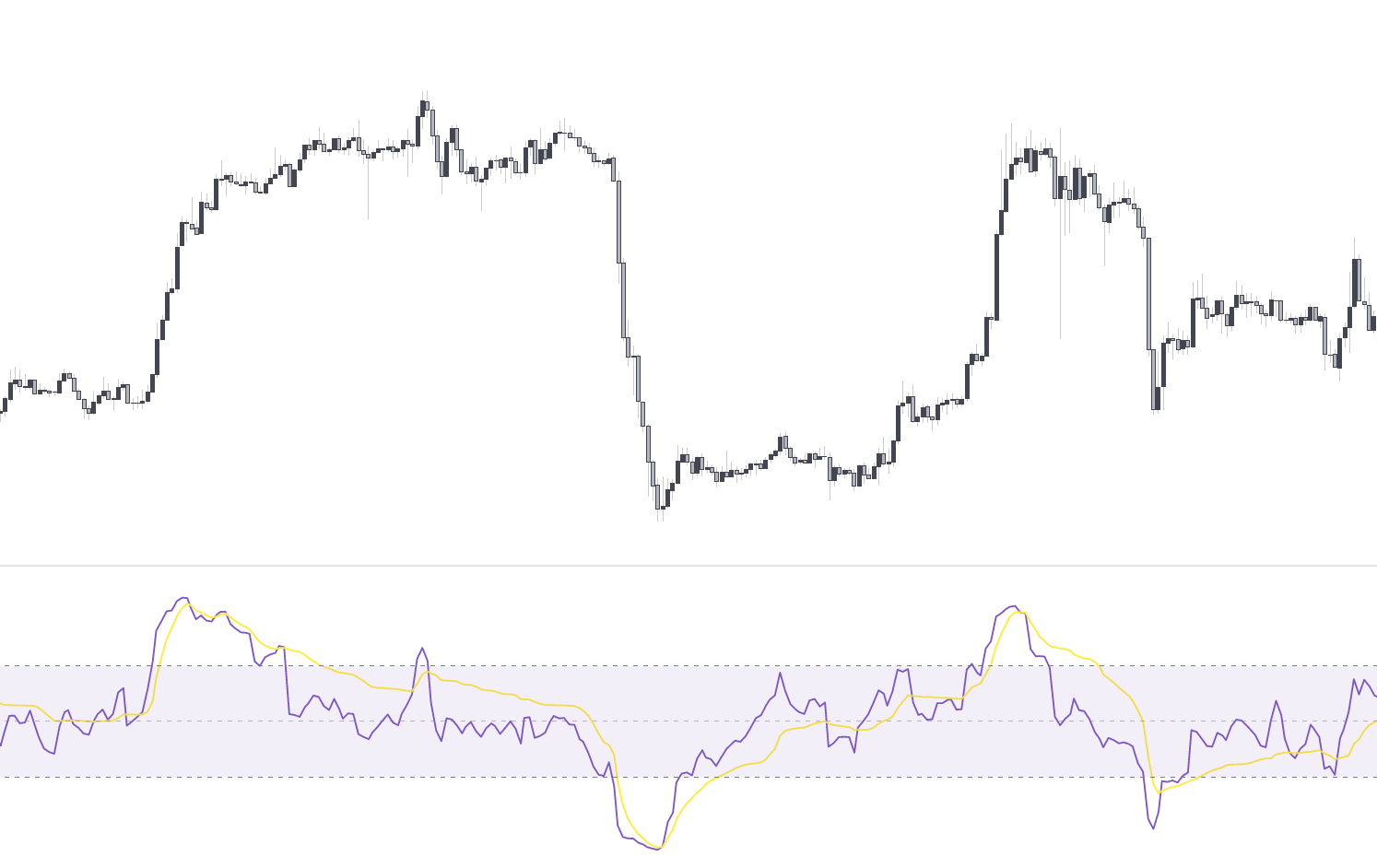

The Ultimate Relative Strength Index (URSI) aims to better consider the trend component in the price by introducing persistence in order to avoid potential whipsaw signals. This returns smoother results as well as less premature overbought/oversold crosses.

The Length setting of the RSI is equivalent to half the Length of the Ultimate RSI, and as such a Length 14 RSI would be equivalent to a Length 28 URSI.

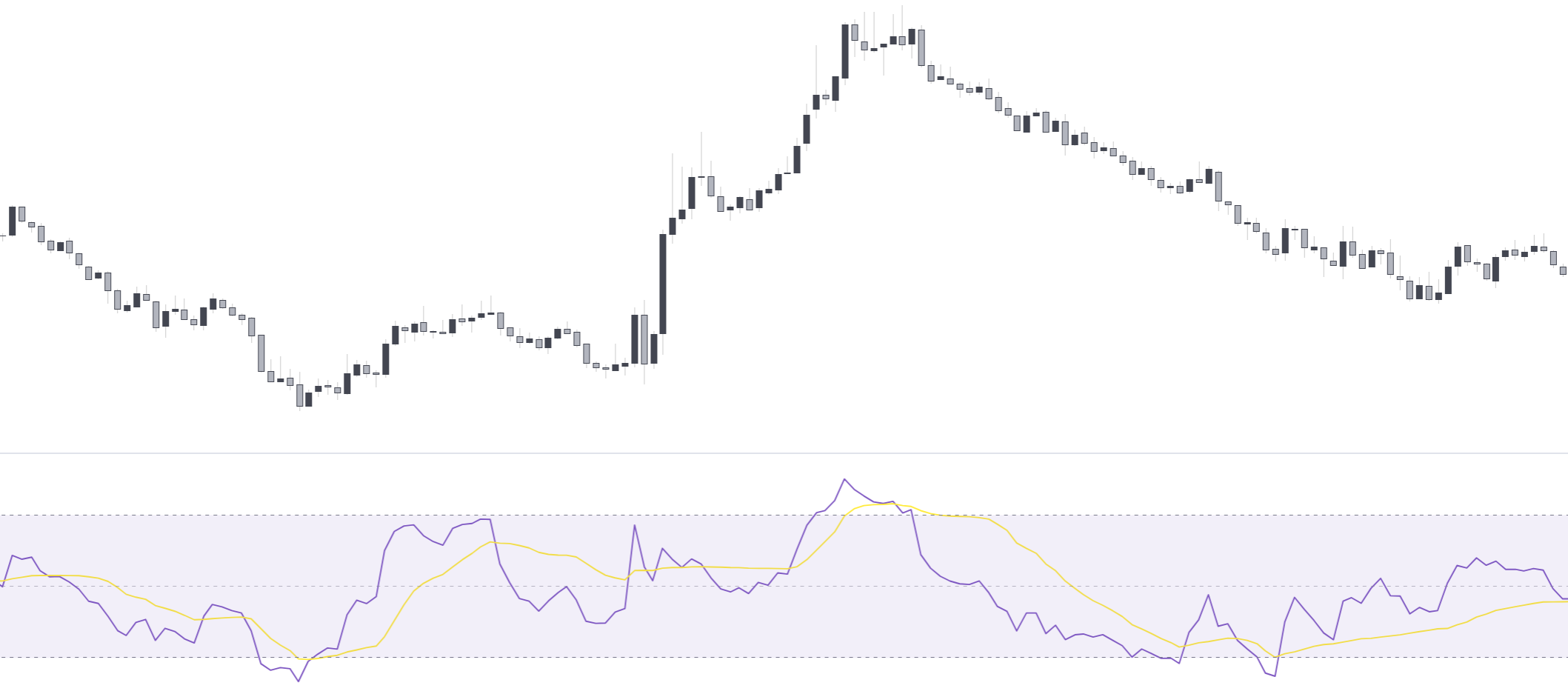

The Ultimate RSI is displayed alongside an adaptive moving average serving as signal line, allowing users to infere uptrend and downtrends from crosses. This signal line adapts dynamically to the market condition, getting closer to the URSI when the market is overbought or oversold, allowing for easier crosses.

Like with the regular RSI indicator the Ultimate RSI can return divergence with the price. In the occurence of significant retracements the Ultimate RSI can anticipate trend reversals.