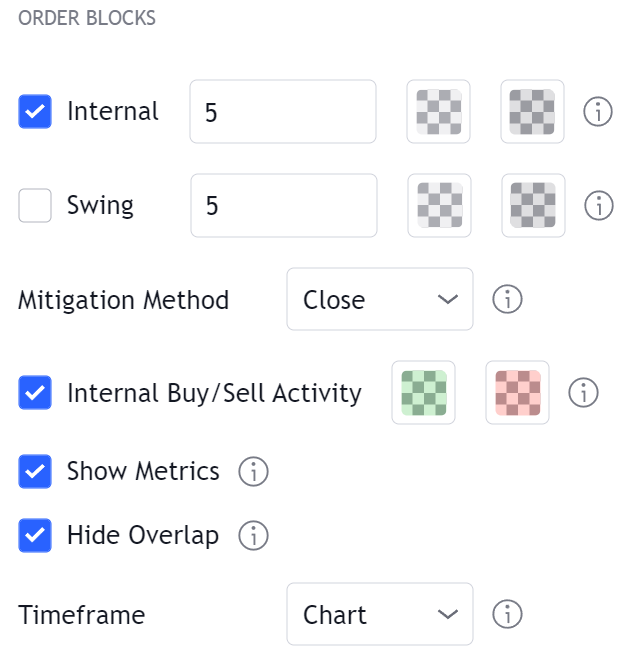

Order Blocks

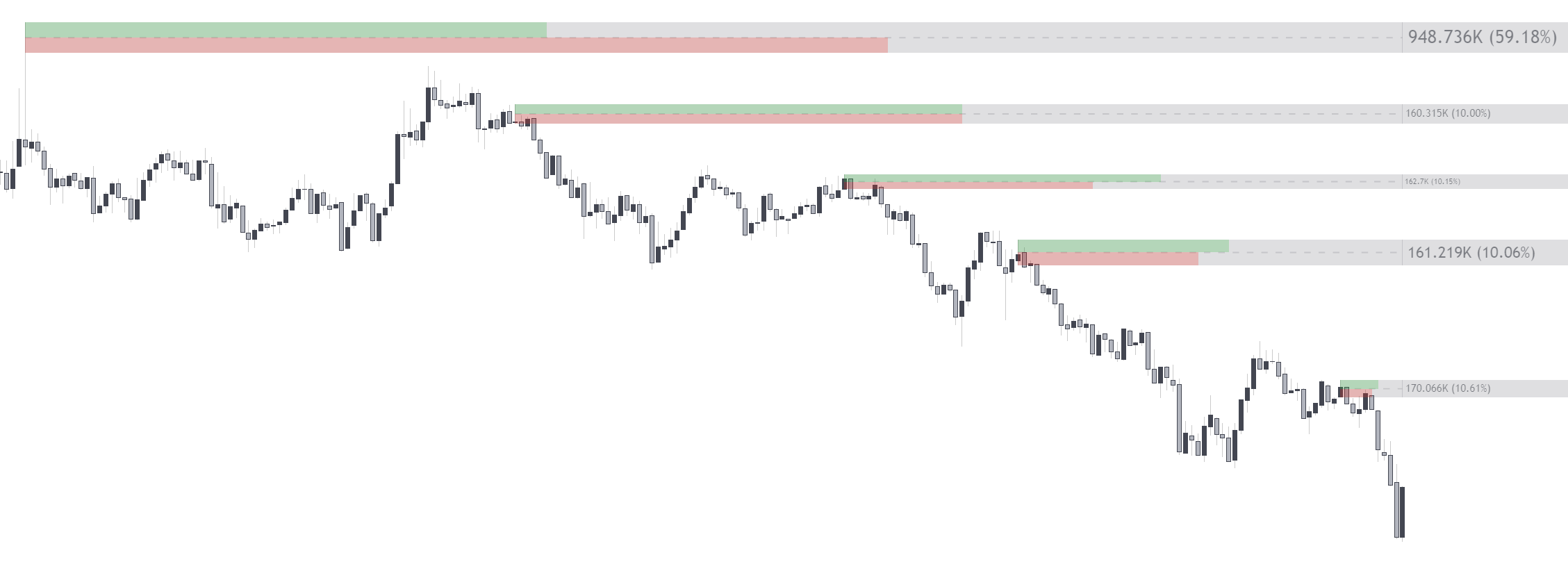

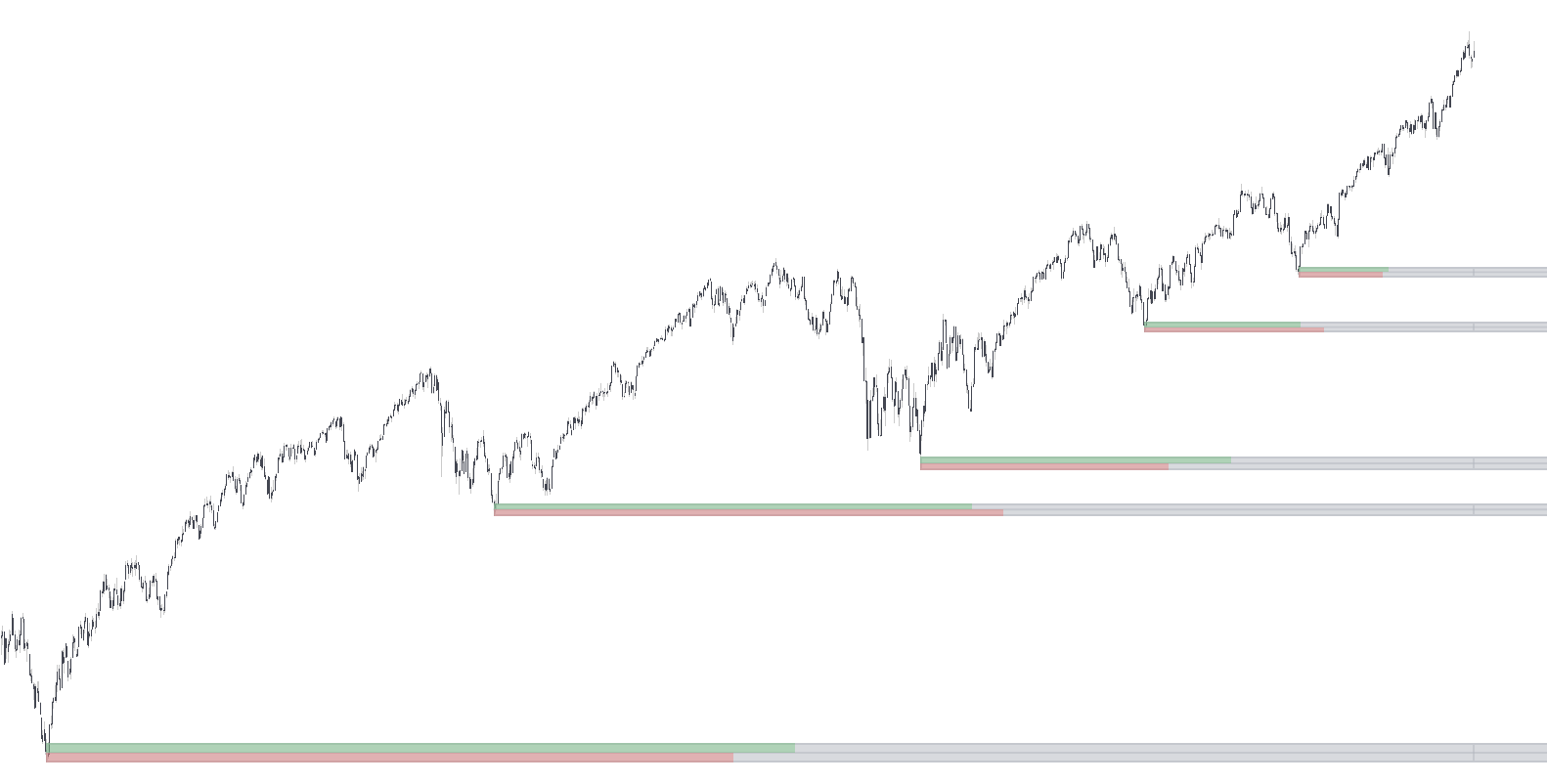

Order blocks highlight price areas where more informed market participants placed orders and can be used as potential areas of support or resistance. These are automatically highlighted by the toolkit and will disappear once mitigated.

Order blocks are separated into two types, bullish order blocks and bearish order blocks. Bullish order blocks initial locations are near swing low's and are used as a potential support. On the other hand Bearish order blocks initial locations are near swing high's and are used as a potential resistance.

Swing & Internal Order Blocks

Much like market structures the toolkit separate order blocks in two categories:

- Internal order blocks

- Swing order blocks

Internal order blocks are constructed from internal trends within a longer term trend. These can be considered less significant and can provide shorter term support/resistance compared to swing order blocks.

However Swing order blocks constructed from longer term trends, and can return supports and resistances for longer term price variations.

Each is has a unique style in order to be differentiated, with swing order blocks having a solid borders and a solid average level instead of a dashed one.

tip

You can hide overlapping order blocks by using the Hide Overlap setting, if two order blocks overlap the most recent one will be conserved.

Internal Activity & Metrics

The toolkit is able to return various information regarding an order block. Internal activity highlight the bullish and bearish activity within the interval used to construct the order block, with green bars highlighting bullish activity, and red bars highlighting bearish activity.

This allows to see if the activity associated to an order block is in accordance with its type, or if the activity is uniform.

info

Internal activity and metrics both requires volume data in order to be displayed.

Metrics

Metrics are displayed to the right of an order block near the most recent historical price bar. This information represent the accumulated volume within the interval used to construct the order block, and can be useful to determine how significant an order block is, with larger volume indicating a more significant order block.

The percentage to the right indicates how much the volume of an order block account for the total accumulated volume of all order blocks displayed on the chart of the same category (internal/swing), this allows to quickly determine which order blocks can be more inreresting to look for.

tip

You can change the size of the the metrics from the OB Metrics Size setting within the GENERAL STYLING settings section, available options include: tiny, small, normal (default), and auto.

Mitigation Methods

Once price break an order block this order block is said to have been "mitigated", and will automatically disappear. Users can determine the condition for an order block to be considered mitigated trough the Mitigation Method setting, available options include:

- Close

- Wick

- Average

The Close option will remove an order block once price close above its top in the case of a bearish order block, and under its bottom in case of a bullish order block.

The Wick option will remove an order block once price high reaches its top in the case of a bearish order block, and when price low reaches its bottom in case of a bullish order block.

The Average option will remove an order block once price cross the average level of an order block.

info

Builtins alerts for order blocks mitigation are available to the users.

MTF Order Blocks

The user can display internal and swing order blocks of an high or lower chart timeframe on the chart using the Timeframe settings. The displayed order blocks will have the same price values and volume data than the ones of the selected timeframe.

warning

The time location of an order block of a different timeframe can differ from the location on its chart timeframe, this behaviors is proper to the tools used to retrive order blocks data on different timeframe.

This can also affect when an order block data is retrieved, potentially causing mitigated order blocks to appear unmitigated.