Entry Rules

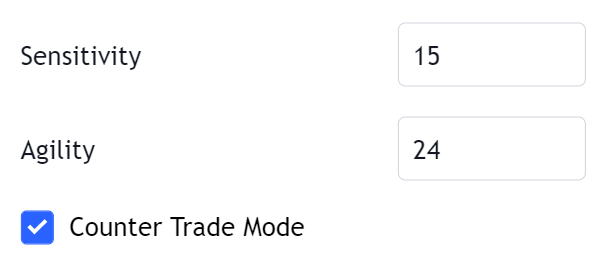

The LuxAlgo backtesting system make uses of confirmation signals as entries for the strategy, longing on any buy signals and shorting on any sell signals. Users can change the sensitivity and agility of the confirmation signals from their respective input settings on top of the script.

By default backtesting is performed using the most recent 2000 bars, this value can be changed from the Backtest Window setting within the ADVANCED settings section.

tip

More information regarding signal settings can be found here

When a new signal is trigerred the previous opened position is closed, then a new position is opened.

info

By default a position size of 1 contracts is used. Spreads and slippage are not taken into account.

Entry Conditions Filters

| Buy Filters | Sell Filters |

|---|---|

|  |

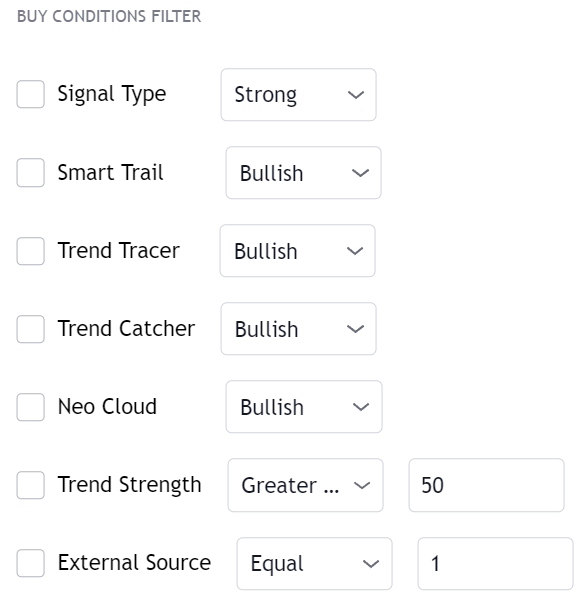

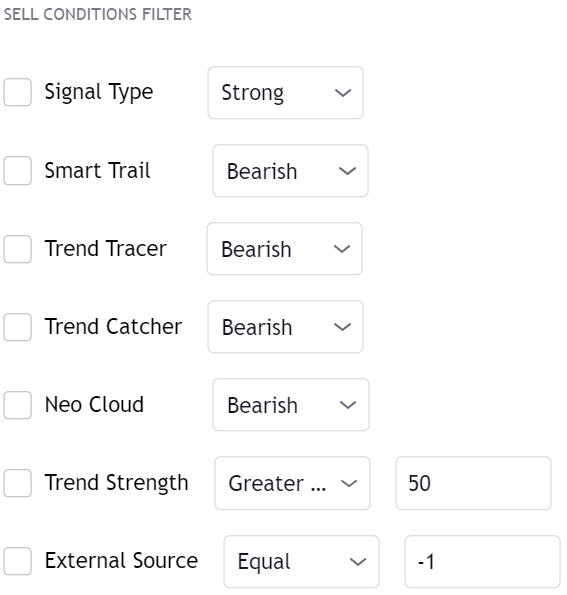

Users may wish to filter out certain signals, only entering position when specific multiple conditions are met. The LuxAlgo backtesting system includes various builtins filters, these includes:

- Filtering signals by their type, only entering if a specific signal is normal or strong

- Filtering signals using the Smart Trail indicator, only entering a specific signal if the Smart Trail is bullish or bearish

- Filtering signals using the Trend Tracer indicator, only entering a specific signal if the Trend Tracer is bullish or bearish

- Filtering signals using the Trend Catcher indicator, only entering a specific signal if the Trend Catcher is bullish or bearish

- Filtering signals using the Neo Cloud indicator, only entering a specific signal if the Neo Cloud is bullish or bearish

- Filtering signals using the Trend Strength metric, only entering a specific signal if the Neo Cloud is bullish or bearish

- Filtering signals using an External Source, only entering a specific signal if the external source is Greater/Lower/Equal than a provided value

info

The external source is specified by the External Source drop down menu in ADVANCED settings section.

Different filters can set for buy or short orders, with buy orders filters being set from the BUY CONDITIONS FILTERS settings section, and sell orders filters being set from the SELL CONDITIONS FILTERS settings section.

Multiple filters can be enabled at the same time, in which case the backtester will require all filter conditions to be true in order to fill an order.

note

If the Exit On Opposite Signals setting is enabled, signals with unmet filter conditions will serve as exits for any opened position, for example if a current position is long and a sell order with unmet filtering conditions occurs, the previous long position will be closed.

Counter Trade Mode

By default the strategy will open long position on any Buy signals, and short positions on any Sell signals. Counter trade mode allows to invert entry conditions, longing on Sell signals and shorting on Buy signals, with the effect of inverting backtest results.